Card dues & gold loans beat bank credit growth of 20%

MUMBAI: For banks, credit card outstanding and gold loans remain outliers in growth. The segments recorded a year-on-year increase of 26.2% and 29.7% respectively as of May 2024.

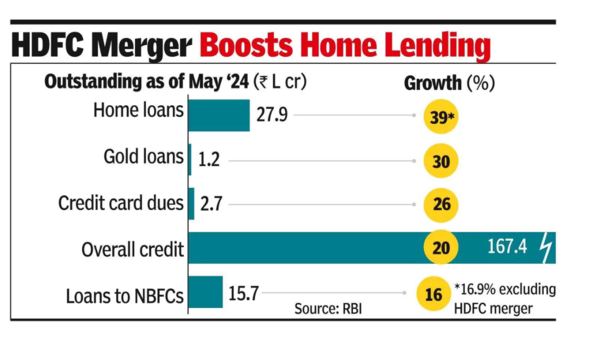

This is much higher than the 19.8% growth in overall bank credit which – adjusting bank’s books for the addition of loans due to HDFC’s merger with HDFC Bank – shrinks down to 16.1%.

The increase in credit card and gold loans comes at a time when RBI has expressed concerns over unsecured credit and is taking a hard look at the gold loan books of some lenders, given the surge in prices of the yellow metal.

Another segment that has been of concern to RBI – bank credit to non-banking financial companies – has moderated. But this segment’s growth is still faster than overall bank credit growth at 16%.

Monthly sectoral data on bank credit released by RBI shows that credit card outstanding stood at Rs 2.7 lakh crore as of May, up from Rs 2.6 lakh crore at the end of March 2024 and Rs 2.1 lakh crore a year ago.

Banks’ gold loan books stood at Rs 1.2 lakh crore at the end of May, compared to Rs 1 lakh crore at the end of March and Rs 90,036 crore in the year-ago period. Bankers said that the increase could also have been due to an increase in market share from NBFCs. Credit cards and gold loans are watched carefully because they reflect household indebtedness and at times financial distress.

The personal segment, with a year-on-year growth rate of 28.7%, continues to be the fastest-growing among industry, agriculture, services and personal loans. However, this is due to the HDFC-HDFC Bank merger, which has resulted in home loans growing nearly 39% yearly (16.9% excluding the merger).

Excluding the merger impact, services are the fastest-growing segment at 23.2% versus 17.8% in the personal segment. A large component of service industry loans comprises of providing loans to lenders.

While the growth rate in credit to NBFCs has moderated from a high of 27% a year ago, the book size continues to remain large at nearly Rs 15.7 lakh crore – up 1.3% from Rs 15.5 lakh crore in March.