Income tax demand of up to Rs 1 lakh/person to be withdrawn

MUMBAI: Government has begun the process of extinguishment of old outstanding small income tax demands after setting a ceiling of Rs 1 lakh per taxpayer. Taxpayers can check the status of the demands by logging on to the I-T portal.

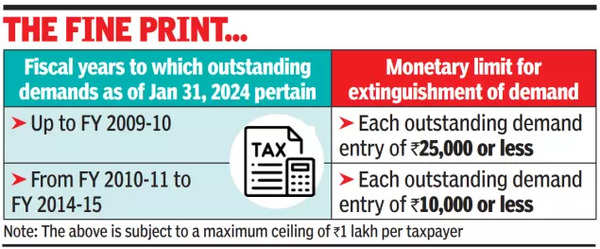

As was mentioned by FM Nirmala Sitharaman in her interim Budget speech, I-T department will withdraw small outstanding direct tax demands of Rs 25,000 or less which pertained to the period up to FY10 and of Rs 10,000 or less for the financial years from 2010-11 up to 2014-15. Sitharaman had said that this would benefit about 1 crore taxpayers. Govt officials had pegged the total value of cancellation of these demands to be around Rs 3,500 crore.

In its recent order, CBDT said that such small tax demands that were outstanding as on Jan 31, 2024 raised under the I-T Act and also under the erstwhile Wealth Tax and Gift Tax Acts, shall be remitted and extinguished subject to the ceiling of Rs 1 lakh for a taxpayer. CBDT clarified that this limit of Rs 1 lakh covers outstanding demand entries in the books of the tax authorities in respect of the principal tax component, and interest, penalty, fee, cess or surcharge under the three tax acts.

“In other words, the thresholds set for each year would apply subject to the overall threshold of Rs 1 lakh per taxpayer. It should also be noted that if an outstanding for a particular year is beyond the value prescribed for that year, say Rs 30,000 for FY11, it will not be considered, even if the taxpayer has no other outstanding demand and this limit falls within the overall limit of Rs 1 lakh,” Ameet Patel, tax partner at Manohar Chowdhry & Associates, said.

CBDT clarified that extinguishment of demands does not entitle the concerned taxpayers to any claims for credit or refunds. Further, such extinguishment will not provide any immunity from any criminal proceeding which is pending, initiated or even contemplated against the taxpayer.

There is a grey area which requires explanation. CBDT’s order states that consequent to the extinguishment of the outstanding demand, there shall be no requirement to calculate interest under section 220(2) of the I-T Act, and the corresponding sections under the Wealth Tax and Gift Tax Acts. This interest is charged for delay in payment of the tax dues.

“However, if such interest was already levied and is part of the demand outstanding in the books of the revenue authorities, will it be covered by the aggregate limit of Rs 1 lakh? This requires a clarification,” Patel said.

It should be noted that demands, even if within the limits prescribed, raised against those required to deduct/collect tax at source, under the I-T provisions relating to TDS or TCS shall not be extinguished.